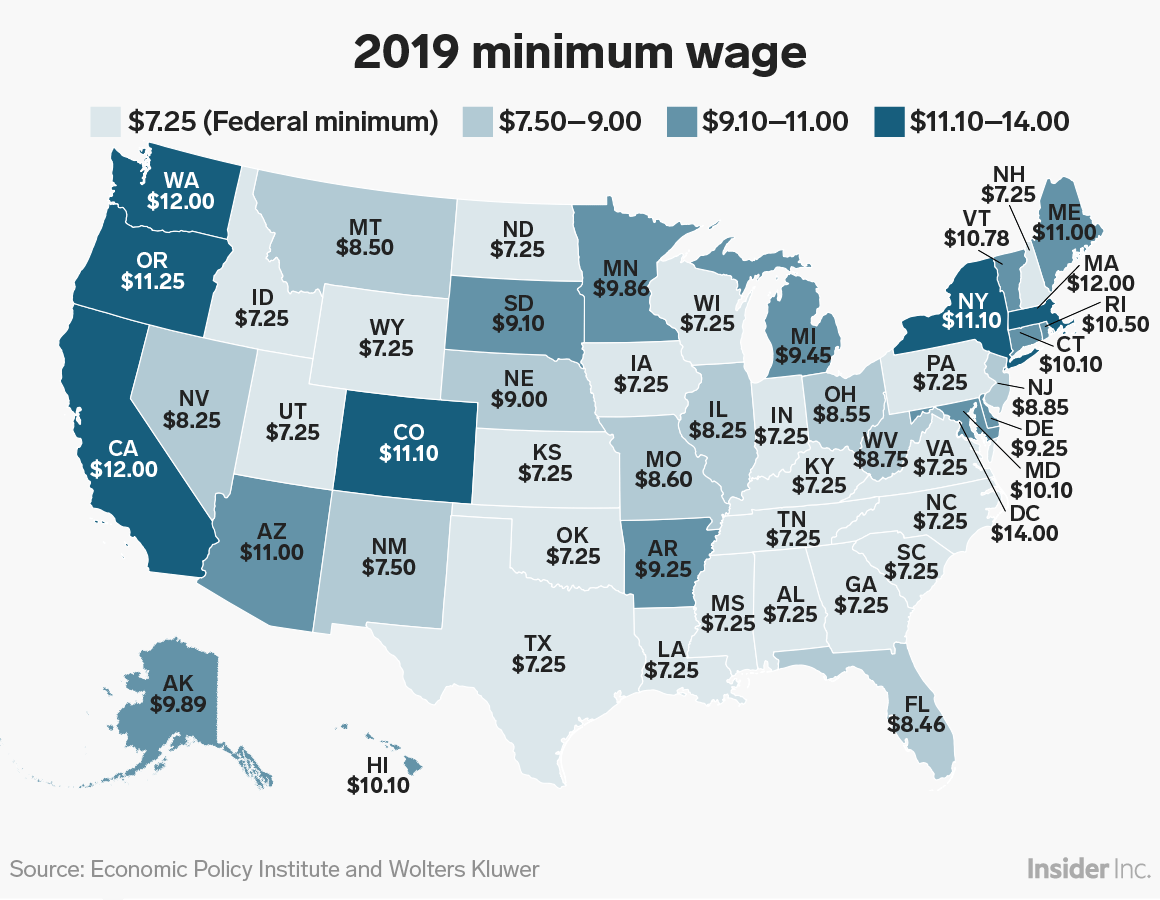

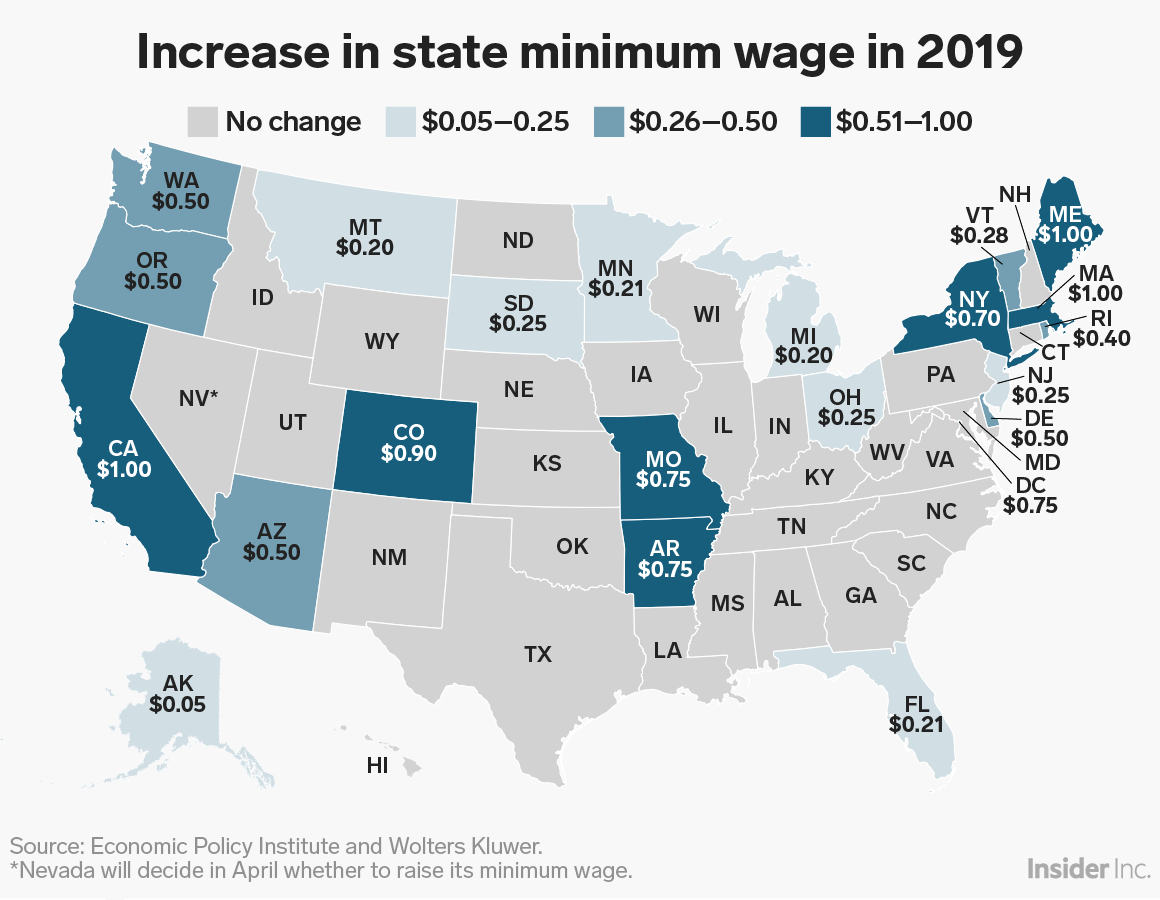

Arizona is now part of 29 states that have minimum wages higher than the federal minimum wage of $7.25 an hour. It is also important to note that Arizona is part of 20 states and close to two dozen cities that will have new minimum wage requirements that take effect in, 2019. See the charts below to see a listing of the various state minimum wages and the amount of increase that is occurring in each of these states.

New York – December 31, 2018

Michigan – April 1, 2019

Oregon and DC – July 1, 2019

Delaware – October 1, 2019

So make sure to take into consideration these wage law changes as we begin 2019. For any outstanding questions or concerns, call us here at Price Kong and we will be able to assist you.

About the Author:

He is a member of the Arizona Society of Certified Public Accountants, the American Institute of CPAs, and serves as the Treasurer for ICM Food and Clothing Bank. You may reach Arturo at his direct phone: 602-776-6334 or by e-mail at [email protected].