Trusted Advisors Dedicated to Growing Successful Cannabusinesses

Price Kong has represented the cannabis industry throughout the United States and Canada for over a decade and continues to expand its services to meet the needs of cannabusinesses.

We Know Cannabis.

In-depth knowledge and industry experience, coupled with our commitment to the success of our cannabis clients, is what differentiates Price Kong from other accounting and CPA firms. Our clients range in size from locally owned businesses to large, publicly traded companies with multiple locations nationally. Your cannabusiness needs more than traditional accounting and tax services to stay ahead of the ever evolving regulatory and tax laws. It needs trusted advisors that understand how to comply with the unique requirements of each state authority.

Since 2011, Price Kong has provided high-quality tax, attest, consulting, accounting, and compliance services to cultivators, processors, extractors, warehousers and distributors, transporters, dispensaries, investors, and other ancillary businesses. Price Kong also advises on financial growth, mergers and acquisitions, cost accounting, compliance reporting, and strategic planning. Our professionals have spent thousands of hours collectively researching and studying the cannabis industry and the many complexities that affect it. Our proprietary time and money-saving models, strategies, and processes have been implemented at

dozens of cannabis businesses throughout the United States and Canada.

Price Kong also has strong relationships with other professionals that support the cannabis industry, including bankers and commercial real estate brokers. In addition, we have built a network of attorneys who help our team stay current on the ever-changing laws and regulations associated with the cannabis industry and are available to assist our clients when needed.

Tax and Attest

Cannabusinesses are faced with unique tax challenges. Tax law in general can be confusing, but conflicting federal, state, and city tax requirements and regulations make managing a successful, compliant business all the more difficult. Whether you are established or just starting out, Price Kong can help ensure your business is a legal, tax-paying entity. Our tax strategies take into consideration all resources available to optimize deductions and minimize your tax liability, while ensuring 280E compliance.

Price Kong also assists with IRS matters, including filing back taxes, resolving IRC Section 280E compliance disputes, minimizing tax penalties, negotiating installment agreements and payment plans, interpreting and responding to IRS notices, and settling payroll tax issues.

Our experience attest team provides services that are often required by state regulation authorities, including financial statements audits. Those audits must be conducted by an independent CPA that meets the American Institute of Certified Public Accountants (AICPA) requirements. In addition, Price Kong auditors work with cannabusinesses to provide financial review documentation to investors, and advise clients on financial preparedness in relation to mergers and acquisitions

Our Cannabis Team Leaders

TROY GRIFFITH, CPA, AUDIT PARTNER

[email protected] | 602.776.6367

Troy leads the firm’s cannabis industry team. He has been working in public accounting since 2009 and received his CPA license in 2013. His previous experience includes working for BDO in Anchorage, Alaska, where he led audits of numerous for-profit and non-profit businesses. Troy has been at Price Kong since 2014 and led the development of the Accounting firm’s audit methodology for cannabis businesses. Troy is heavily involved in substantially all of the firm’s cannabis company audits and has an intricate understanding of dispensary operations, controls, and metrics.

As senior manager, Troy ensures audits are completed in accordance with required auditing standards and the unique state compliance regulations. Troy also consults with cannabis and hemp companies on potential M&A transactions, IFRS reporting, due diligence requests, and operational controls.

Melissa Harrington, Senior Tax Manager

[email protected] | 602.776.6329

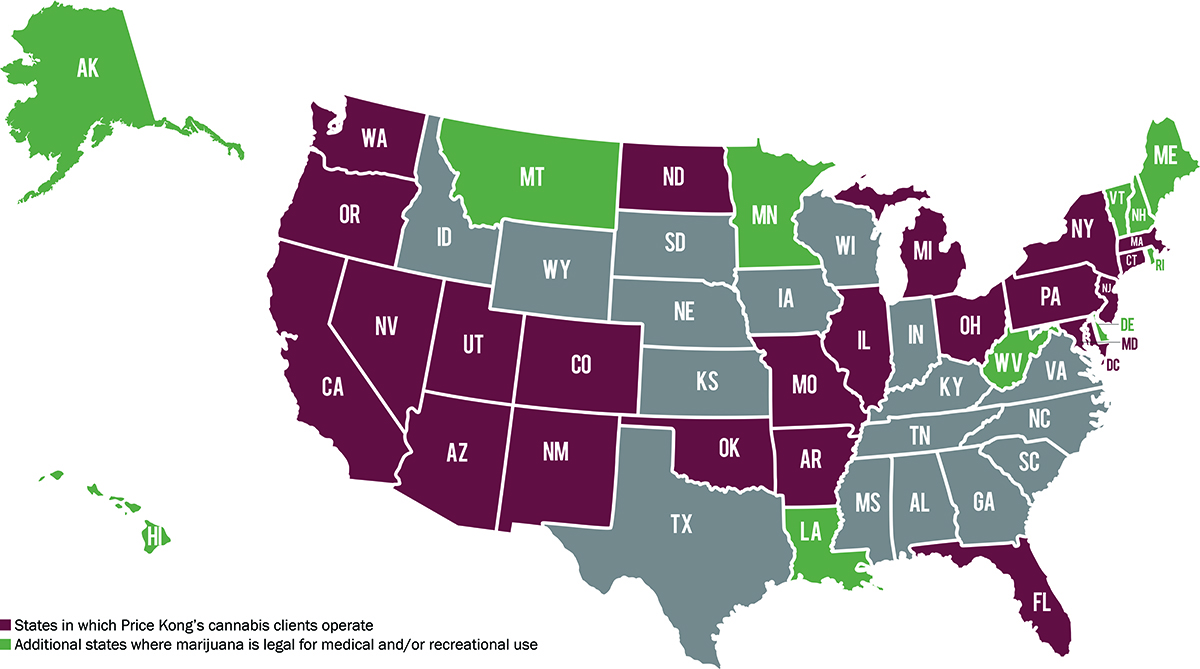

Where Our Cannabis and Hemp Clients are Located